The COVID-19 pandemic has fundamentally changed many core business functions, including employee payroll. Payroll is typically an invisible function for most organizations that isn’t given a lot of thought, but making sure employees are paid what they’re owed on time is vital to keeping them safe, motivated, and fulfilled.

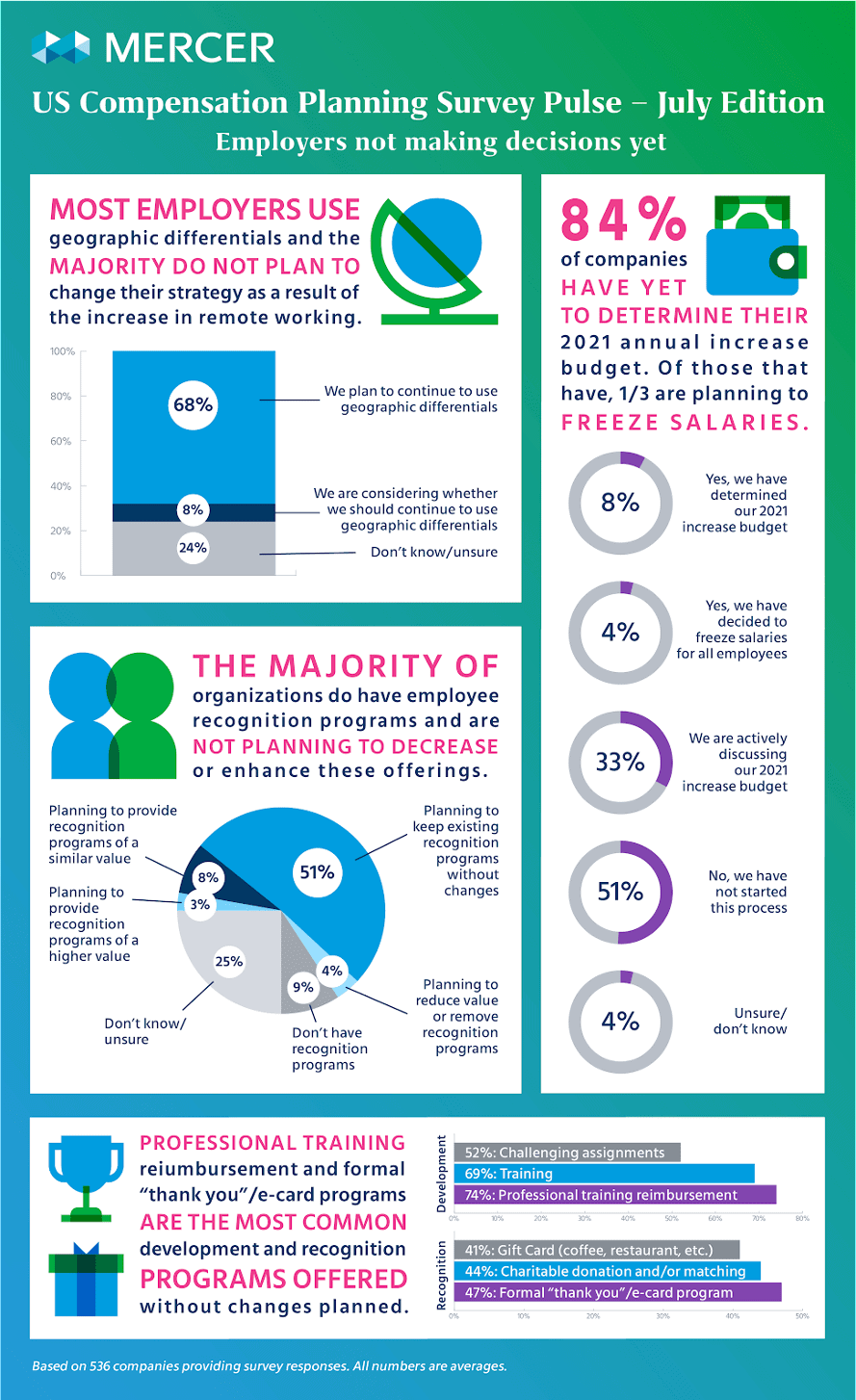

According to the latest Mercer Compensation Planning survey, a majority of companies struggled to finalize their annual payroll forecast. Of the total responses, 88% indicated they were “still discussing”, remained unsure, or hadn’t even begun working on their payroll budgets for next year. The remaining companies indicated they would be freezing salaries.

A lot of the hesitation stems from concerns over what lies ahead. With this much uncertainty, what can businesses do to develop their post-COVID-19 payroll strategy?

How Has COVID-19 Impacted Payroll?

The COVID-19 pandemic has had devastating consequences for many businesses. Even after the introduction of the Paycheck Protection Program (PPP) and Employee Retention Credit (ERC) program, which provided economic recovery funds to small businesses, many organizations are still suffering.

In May last year, 94% of surveyed employers completed planned 2020 pay increases and 75% made their anticipated incentive and bonus payments. It’s important to note that these increases were based on past employee performance from early 2020 and late 2019. As employers look ahead at compensation plans for 2022, it has become much more difficult to keep the same trajectory of pay increases.

To combat the impact of the pandemic, many businesses have shifted their teams to working remotely. This shift was more seamless for certain business functions, but presented unforeseen challenges for HR and payroll employees.

Prior to the pandemic, many payrolls relied on physical forms and bank checks to carry out daily operations. Additionally, critical payroll staff were prone to effects from the virus—whether they contracted it themselves, needed to care for a family member, or had new parental duties due to childcare and school closures. Payroll staff also rely on many vendors, which are each dealing with their own business and payroll continuity challenges.

What is Payroll Continuity?

Payroll is part of the lifeblood of an organization. Businesses who cannot pay their employees on time for their owed wages risk having disgruntled, unmotivated staff, and even incur fines from tax and social security offices. Payroll continuity means there is no interruption to the standard payroll procedure, even in times of uncertainty. So, what can you do to minimize risks and ensure a seamless payroll process for employees after the pandemic?

Key Considerations for Payroll Continuity

Businesses should start by understanding the risk exposures to their payroll to assess their payroll continuity readiness. EY has identified seven key considerations when assessing a business’s continuity readiness:

- Payroll Organization: Identify who is responsible for payroll functions at each location. Understand their key responsibilities and establish a hand-off plan in case of emergencies.

- Staff Availability: Create plans for instances where there may be limited staff availability and factor in potential overtime costs.

- Work From Home Arrangements: Ensure key payroll and HR staff are equipped to work from home with the proper tools, internet bandwidth, and digitized processes.

- IT Infrastructure: If payroll must work remotely, confirm if their processes are remotely accessible. Pay extra attention to data confidentiality, IT security, and any tech vulnerabilities.

- Physical Processes: Determine if any physical processes exist in your current payroll process. Can they be digitized? If not, will their function be impacted by limited physical access?

- Access to Payroll Data: Confirm your ease of access to former payroll entities such as pay-slips, ledgers, and general payment files.

- Releasing Bank Payments: Confirm if bank payments can be released remotely.

After taking the time to review each key indicator, if there are any glaring holes in your existing payroll, now is the time to address them. By addressing the problems now, businesses will be prepared for unforeseen circumstances in the future.

Automation Is Key to Staying Competitive

Businesses assessing their risk exposure will often find that paper forms and in-person procedures are among key concerns. The COVID-19 pandemic shifted a huge portion of the workforce into remote work. 55% of employers anticipate that a majority of their staff will remain remote long after COVID-19 has passed. Even if your business is operating in person, it’s likely the vendors and partners you work with are operating at least partially remotely.

Either way, it’s clear that businesses need to prepare for digitizing their processes. For payroll, automation can help replace physical forms, mass printing, bank checks, and signing and distributing. Even industries like banking and government that have historically been slower to adopt digitization are looking to replace manual processes.

Automation can help future-proof your payroll through cost savings, minimizing errors, and streamlining repetitive processes. Consider integrating time tracking software with your payroll systems to automatically record attendance, calculate work hours, and streamline your payroll system. Digitally transforming your payroll using payroll software is one of the best ways to minimize your payroll continuity risks.

Payroll Continuity in Times of Uncertainty

In addition to standard payroll procedures, employers are beginning to redefine their employee experience through the use of recognition and development programs. Employers who are conducting compensation planning for 2022 and beyond are not only considering pay levels but also employee retention and well-being

Most organizations in the Mercer Compensation Planning survey were prioritizing recognition programs such as gift cards, charitable donations, matching programs, and formalizing “Thank Yous”. These recognition programs acknowledge employee performance in place of, or in addition to, monetary compensation.

Looking ahead, employers indicated that development programs such as professional training, certification reimbursements, and cross-functional work assignments were some of their key focuses.

Implementing an Effective Payroll Strategy

With the global pandemic ever-present, organizations should continue to keep employees up-to-date on business practices. It’s important to be forthcoming with employees regarding any changes in payroll including pay cuts, hiring freezes, or reduced benefits.

The best way for organizations to prepare and to keep their employees protected is to understand their payroll continuity readiness. From there, develop an actionable payroll strategy that minimizes your payroll risk exposure and protects your most important asset: your people.

Implementing an effective payroll strategy and streamlining processes is the best way for businesses to be successful even in the times of uncertainty.

Dean Mathews

Dean Mathews